The SPARX index has depth

Quantifying regime change

More experiments with developing ideas using freely available data. If you spot mistakes, have suggestions, or can offer context, please leave a comment. Become a full subscriber to access the full archive and follow ongoing developments.

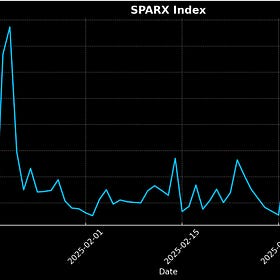

Today we see how market uncertainty dynamics shifted fundamentally in April. We see that this shift is measurable with respect to grid imbalances.

A brief recap if you’re one of the many new subscribers here (welcome!) and haven’t had a chance to catch up with previous posts: we introduced the SPARX index as a measure of uncertainty in the power markets, inspired by and analogous in a loose way to the VIX index in the equity markets (see the Variability Swap series).

Energy Storage Systems and Variability Swaps, IV.

Let’s continue our series on symmetric storage systems as “variability swaps.” We previously said that…

The idea is to look at price difference ranges. These differences indicate the extent to which expectations need adjustment (think delta tracking). The difference range between continuous ID and DA prices reflects 1-day uncertainty, and we’ll abbreviate this as DA_ID SPARX, while the range of differences between 15min and 60min product prices is a gauge for short-term intra-day uncertainty (6015 SPARX).