Platform Theory, Energy Edition I.

An introduction to power trading platforms

Today we’ll dig below the surface to get a sense of the different trading platforms that exist in the energy industry.

An accompanying post will look at the development of the best-known trading technology platforms, featuring Volue PowerBot, Visotech, Trayport’s Joule & autoTRADER, and enspired.

Across the energy trading landscape, many companies describe themselves as offering a ‘platform.’ But the term could mean anything from a UI wrapper on a trading API to a full-stack system handling optimisation, dispatch, and risk.

Consider the following three examples.

Statkraft Unity, our trading platform, allows our customers’ intermittent renewable generation to be scheduled seamlessly. Statkraft, Link

…we built the fastest automated trading platform on the European energy market… Enspired, Link

…delivering market-leading performance for our clients since 2022 through our AI-powered trading platform, which dynamically markets battery storage across various energy markets. Entrix, Link

Statkraft has its own assets, including about 16GW of hydro. Its Unity platform includes services such as ‘balancing, fixed and floating energy prices, options and the optimisation of flexible generation’ which necessarily means that it incorporates technology for plant optimisation, price modelling, and trade execution.

Enspired doesn’t run its own assets, but its ‘platform’ seems to cover all aspects of trading, from modelling to execution. In contrast, Entrix appears to use PowerBot for execution, which implies that it does not see exchange connectivity and execution as part of its core value proposition.

Today we would like to introduce you to Entrix, a German startup that provides a service for battery optimization and trading and they happen to develop their cutting-edge trading algorithms on top of PowerBot for quite a long time already. If you own a battery, Entrix will trade and optimize it for you as a service. PowerBot LinkedIn Post, Link

Entrix is not listed as one of PowerBot’s integrations, which suggests a deeper level of partnership. On the other hand, suena, another trading service provider, is listed among PowerBot integrations. Note that suena does not, as far as I can see, describe itself using platform language.

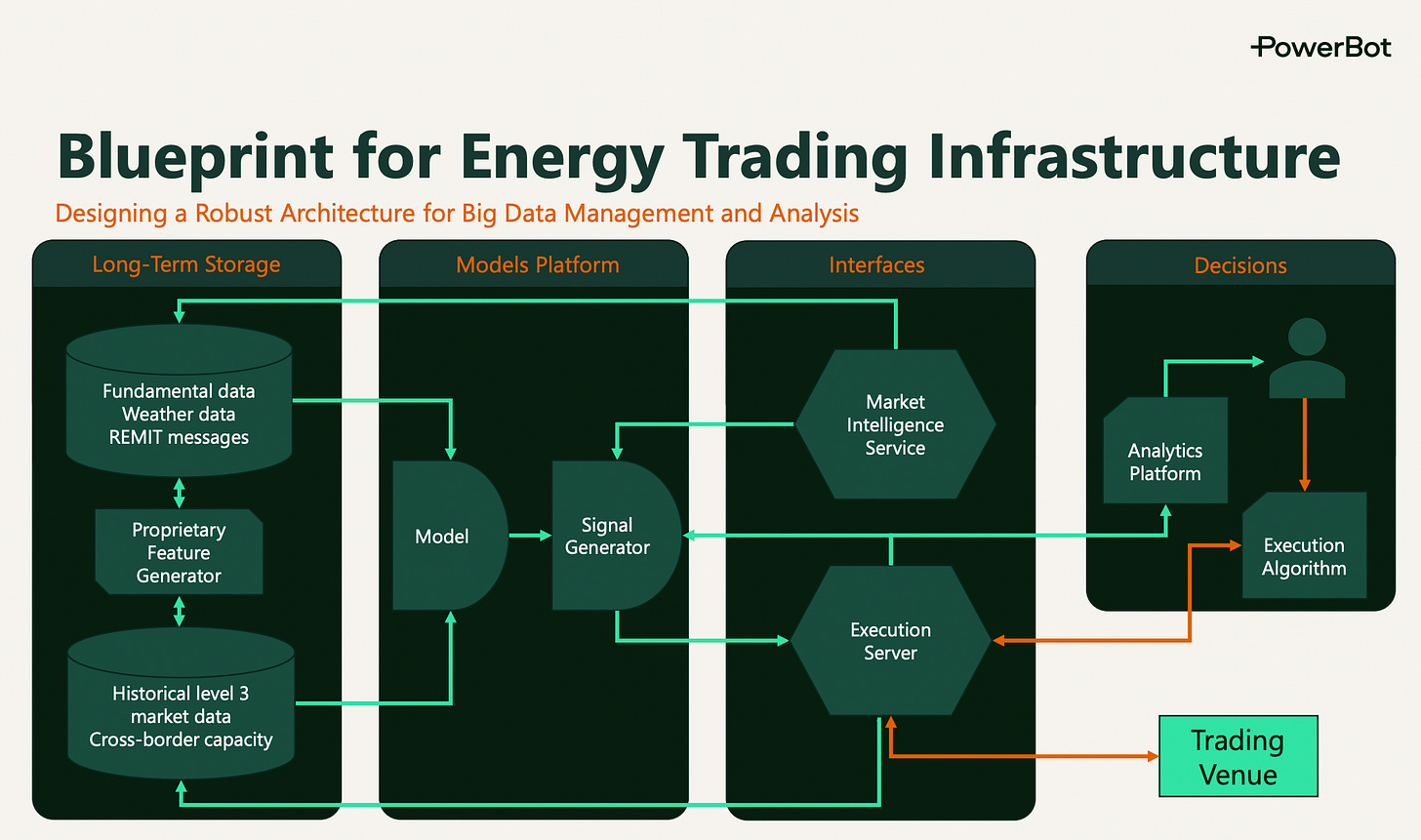

All of this gives us a sense of the range of ‘platform’ flavours in the power trading industry. At the fully integrated end are platforms that combine the optimisation of fleets of power plants with trade execution. At the other end you have technology platforms that provide market access and convenient software infrastructure to run trading algorithms.

Platforms may evolve over time from spreadsheets and manual routines. Here’s one such example revealed through a case study about optimising the power-trading ‘Excel estate’ of ‘the largest Swiss electricity producer.’

The client needed to bring control and scale to their Excel estate, highlighted when auditors raised concerns around their over-reliance on Excel for mission-critical business processes, particularly across Trading, Risk and Finance.

The client’s trading desks were limited in the amount of historical data they could use. Excel sheets had reached their capacity and the processes around them were extremely manual and slow, often resulting in them running on out-of-date data. This was impacting the firm in multiple ways from missed trading opportunities, not having the correct safeguards, and impacting their ability to perform robust stress testing.

Schematiq Case Study, Source Link

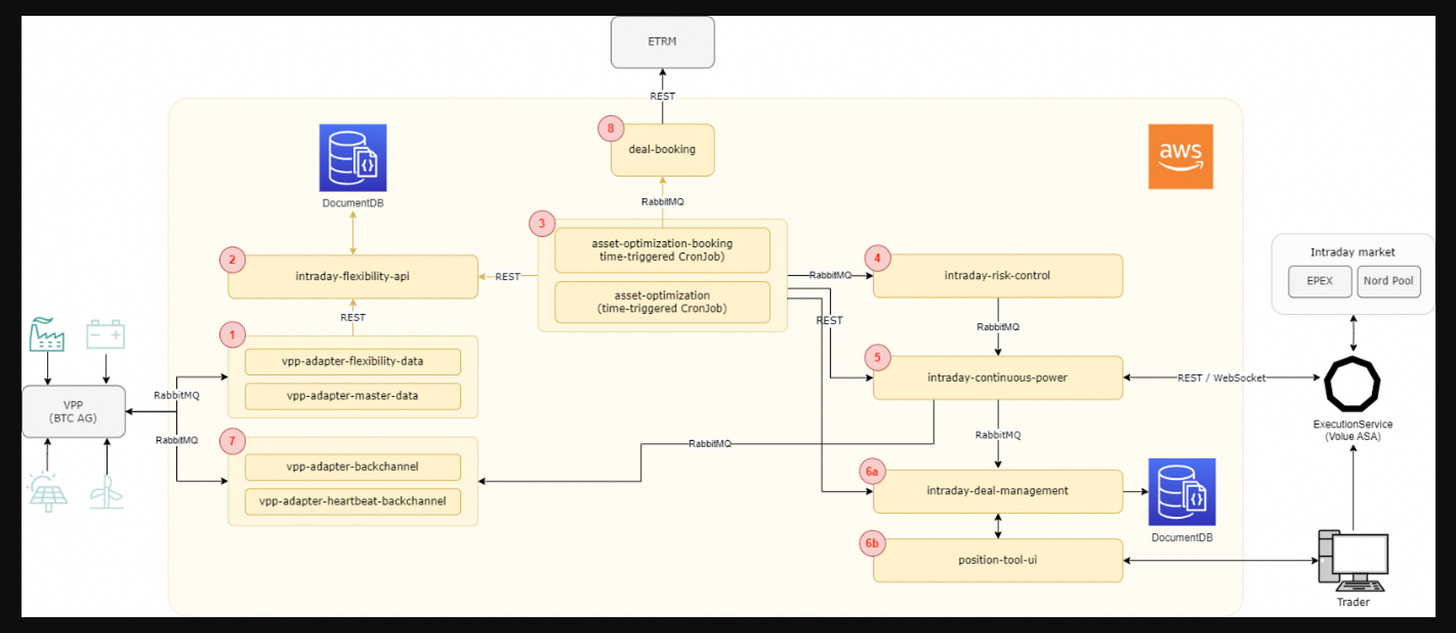

Moving further along development maturity, an AWS case study with EWE trading provides an overview of an internal technology capability that combines plant optimisation with trade execution.

This setup cites integration of the Volue Algo Trader for intraday market access.

The “intraday-continuous-power” adapter uses the powerful order-implementation service Volue Algo Trader provided by Volue ASA to implement access to the intraday market. Volue Algo Trader fully automates intraday trading workflows by realizing programmatic market access to the EPEX SPOT and Nord Pool. At the core, this service is a robust and powerful client-server solution combined with high-performance runtime algorithms. Its use brings significant relief to intraday trading desks, reduces trading costs, and systematically capitalizes on trading opportunities in highly volatile and complex markets. Link.

The case study provides a valuable glimpse behind the scenes: platforms that involve a combination of fleet management, optimisation and trading (e.g. Statkraft Unity) will all, I expect, look more or less like this at a suitable level of abstraction.

Note that intraday trading is the common core capability in this spectrum of ‘platforms’ and that there are two key dimensions for extension from this core capability. One dimension is to optimise assets or fleets of assets as well as to trade them. This is particularly important for ‘virtual power plant’ operators.

Virtual power plants are an interconnected and distributed network of a wide range of energy resources managed by cloud-based data control centers. NCSL, Link

The other dimension is optimisation across a range of markets or market-linked activities, for example ancillary services, balancing group management, option markets, etc.

In the accompanying next post we’ll trace the evolution of the most influential trading platforms and how they are placed along these dimensions.

Platform Theory, Energy Edition II.

We continue from the previous introductory post on trading platforms and look at how some of the well-known technology platform providers have evolved.