If you’re interested in the European Electricity Markets then you will be spending at least some of your weekend thinking about the change to 15 min DA auction products. The shift to 15-minute DA auctions will cascade through the markets. Here’s a ‘digest’ of reflections over the last week or so. I invited LLMs to contribute.

Context. Europe’s Single Day-Ahead Coupling (SDAC) is transitioning from hourly to 15-minute market time units (MTUs) (go-live 30 September with first delivery 1 October). It is a regulatory, system-integration and market-quality reform rolled into one: align the primary price formation process with the physics of variable renewables and with the 15-minute Imbalance Settlement Period. The result is not a mere re-tick of the auction clock; it changes the starting conditions of continuous intraday (ID) trading and, with them, the observed behaviour of the limit order book (LOB).

Below, we integrate the classical microstructure lens we developed last time with the mechanics of European power markets to analyse change. This includes a short excursion into the effect the changes could have on flexible symmetric asset revenue potential in the ID market. The mapping isn’t perfect, but I think the perspective is very useful. Tell me what you think.

Market microstructure: a review of classic foundations with translations to power

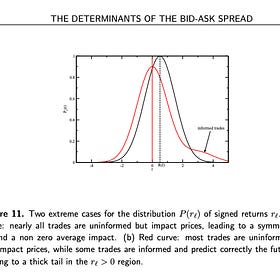

We look at the basics around limit order books (LOB) more closely… The written post complements and extends the attached audio. (The title picture is taken from Bouchaud, Farmer & Lillo, one of the papers we’ll look at in this post.) As ever, please let me know if you spot mistakes or see things differently.

1. What is really changing?

Old regime. DA auction printed hourly prices; ID shouldered the ‘burden’ of within-hour reshaping (quarter-hourly physics vs hourly positions). The 15-minute ID contract functioned as the error-corrector against an hourly benchmark. Unsurprisingly, we saw the familiar “sawtooth” intra-hour pattern: systematic, predictable drift as positions were re-aligned from the hourly DA anchor to quarter-hourly reality.

New regime. DA prints 96 quarter-hours. The same granularity as in continuous trading becomes available a day earlier, inside the deepest, most coordinated liquidity event in Europe. This is a role inversion for the QH product: from secondary adjustment tool in ID to primary unit of price formation in DA. The ID market’s role shifts further toward residual balancing: updated, late, information-dense deviations (forecast updates, plant/state changes, cross-border constraints) rather than the mechanical clean-up of an hourly mis-specification.

Implication. You should expect lower average asymmetry when ID opens (tighter early spreads, flatter impact for routine clips), yet there is risk associated with the change: the multiplication of delivery buckets raises local thinness risk in specific quarters and concentrates stress into shorter, sharper episodes.

2. Liquidity, depth and fragmentation: the arithmetic that matters

The move from 24 to 96 tradable delivery periods changes the way limited quoting capacity and risk limits are deployed. With the same aggregate capital and attention distributed over more instruments, revealed depth per contract can look thinner between refill cycles—even if latent liquidity is ample. This is a standard electronic-market phenomenon, extensively documented in the empirical LOB literature: at any instant, displayed liquidity is small; replenishment is episodic and state-dependent.