Energy Storage Systems and Variability Swaps, III.

Uncertainty and fear

This is the third post in a series reflecting on ‘variability’ in the short-term energy markets and on seeing energy storage systems as variability swaps in one way or another. See also Part 1, Part 2.

If you’re interested in volatility and finance then you’ve probably heard about the VIX index, also known as the ‘fear gauge’ or ‘fear index.’ You may also have heard of the VVIX, which, to quote a recent FT headline, is a ‘[b]enchmark tracking investors’ fear of fear.’

Fear of fear? Apparently we’ve come far since Thoreau and Roosevelt’s 1933 inaugural address: “there is nothing to fear, but fear itself” becomes “there is nothing to fear, but the fear of fear itself.”

The VIX, as we will see, shows how financial abstraction creates new mechanisms for reflexivity. Indeed, the index and the ‘volatility franchise’ it has spawned illustrate the interesting quip of uncertain provenance that “everything you can do, we can do meta.”

The Cboe Volatility Index® (VIX® ) is considered by many to be the world's premier barometer of equity market volatility. The VIX Index is based on real-time prices of options on the S&P 500® Index (SPX) and is designed to reflect investors' consensus view of future (30-day) expected stock market volatility. The VIX Index is often referred to as the market's "fear gauge".

The VIX Index is the centerpiece of Cboe Global Markets' volatility franchise, which includes volatility indexes on broad-based stock indexes, exchange traded funds, individual stocks, commodities and several strategy and performance based indexes, as well as tradable volatility contracts, such as VIX options and futures.

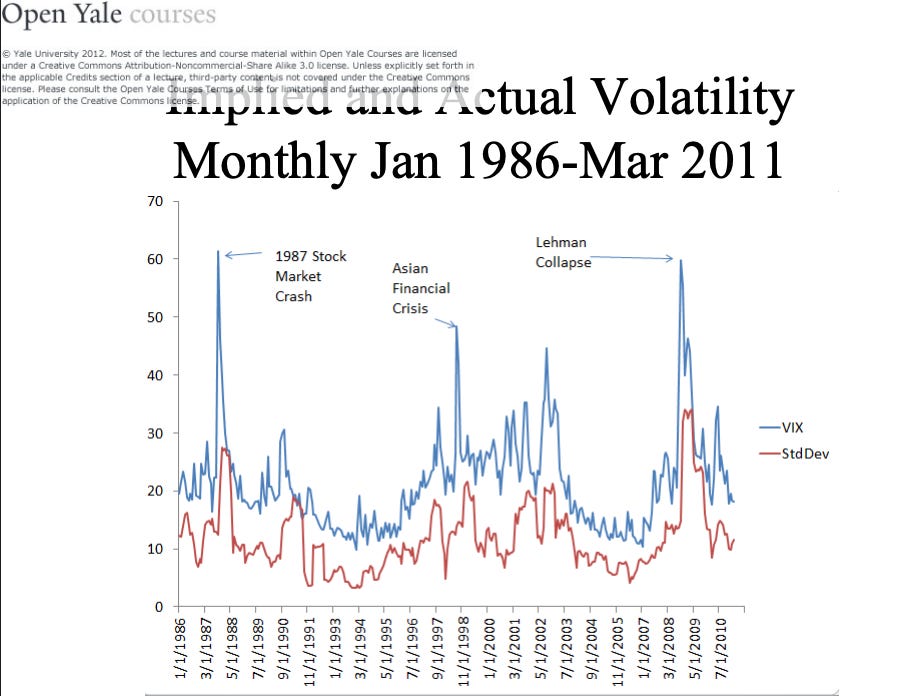

We’ll begin with the picture below from an archived lecture by Robert Shiller. The picture will help us to generate interesting new leads in thinking about symmetric energy assets as variability swaps. The focus is on the short-term markets that energy storage systems tend to participate in. There is, of course, a rich set of markets for longer-term contracts, including, e.g. power options. We might like to think about those markets later.

Here are three questions we will use to develop links between the VIX and energy storage systems as variability swaps.

How does the market provide a structure to express future expectations?

What is a useful way of measuring the uncertainty of these expectations?

How can a measurement of uncertainty be formalised and/or traded?