Asset vs. Portfolio Performance

GSF's investor reporting meets enspired's voluntary self-reporting

As the year ends our thoughts may drift to the past… thoughts of past performance are never far away. As far as BESS performance goes, there’s more and more material to think about. Indeed, if you’ve got both feet in the German BESS scene then you’ve probably spent some time comparing different views of past performance (see for example this link) and you’ll have voiced your own views, perhaps in public (example link).

For our year-end performance reflection, let’s keep the two feet firmly planted and look at actual revenue figures rather than derived measures.

I know of two publicly available sources for German BESS trading results (let me know if you are aware of others), namely:

Gore Street Energy Storage Fund PLC’s (LSE:GSF) periodic financial reporting for their Cremzow asset,

enspired’s reported portfolio revenue performance figures.

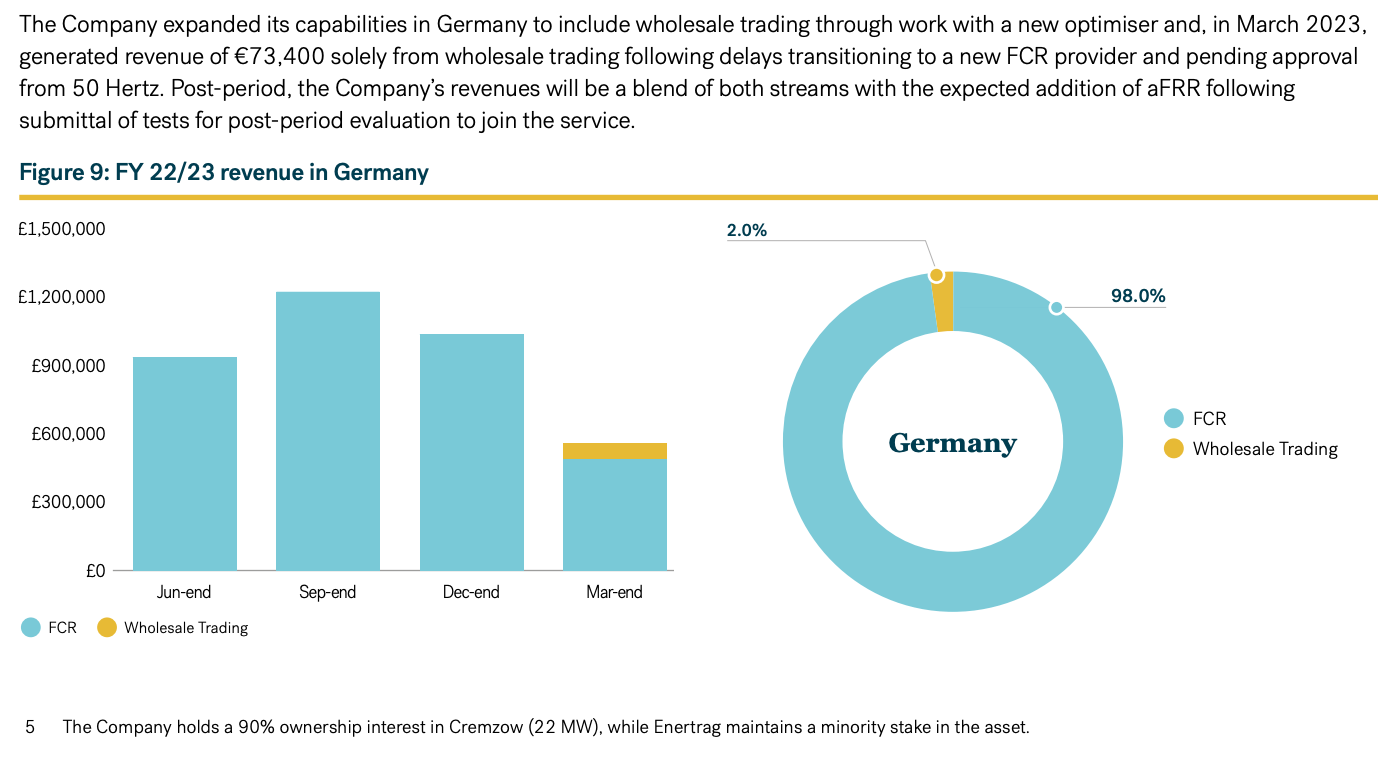

One of these sources may dry up soon. GSF is selling its German asset. Who knows whether the next owner will also be subject to investor reporting requirements (and perform them so well).

If you’ve been following stratnergy for a while you will remember that we’ve previously timed reviews of GSF figures to their reporting cycle.

Let’s now push the mini-series forward while Cremzow is still wrapped into LSE:GSF’s investor reporting requirements. The obvious step is to connect GSF and enspired performance data. Always connect the dots if you can.

Before we go any further, a quick note on the data access and usage... This analysis draws on publicly available investor disclosures published via the London Stock Exchange RNS and on GSF’s website, alongside publicly accessible portfolio performance figures published by enspired (https://www.enspired-trading.com/portfolio-performance). Reported figures are summarised, analysed, newly charted, and interpreted for analytical purposes. Original sources are always cited. Note in this context that enspired’s robots.txt file places no general restriction on accessing published content programmatically. This indicates that the portfolio performance page and its embedded data are intended to be publicly visible and accessible. I take this to be consistent with enspired’s published intent on setting transparency standards. Please let me know if you disagree.

A Review of GSF’s reports (2023–2025)

To put (combined) performance data into context, let’s first review BESS developments in Germany over the last couple of years through the lens of GSF’s investor reports.

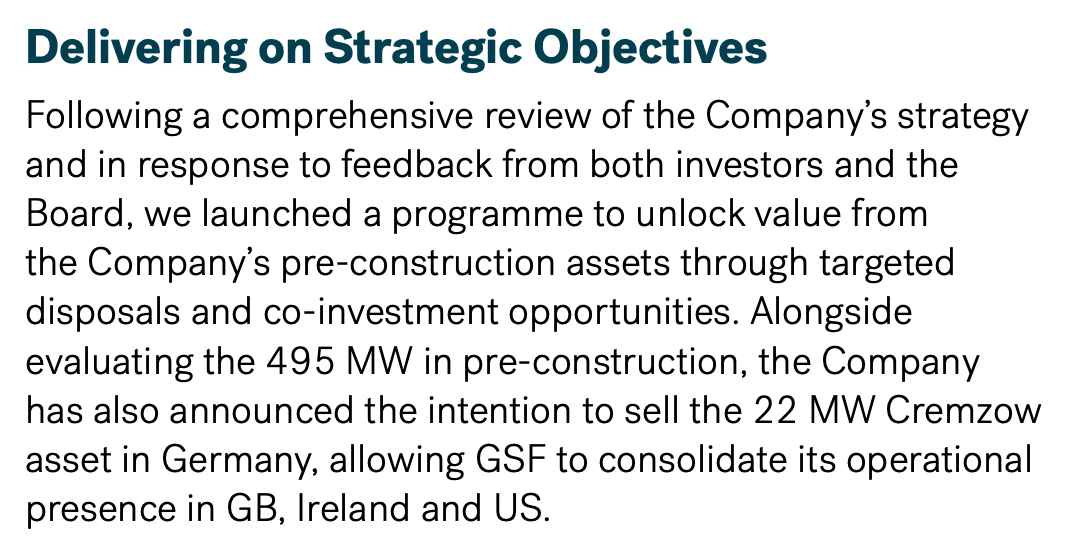

July 2023, Annual Report (FY ended 31 March 2023)

When GSF published its FY22/23 Annual Report in July 2023, the Cremzow asset was FCR-focused. A reasonable approach: good value with low cycle intensity. But the report contains a passage that reflects a turning point in this baseline strategy:

GSF was beginning to optimise beyond FCR by early 2023: intraday trading was live, generating complementary revenues. Indeed, March 2023 revenues came solely from wholesale trading, building confidence in opportunities across markets. GSF expected future revenues to be a blend of FCR and wholesale, with aFRR to be added once testing and approvals were complete.

Report link:

https://www.gsenergystoragefund.com/docs/librariesprovider22/archive/reports/annual-report-2023.pdf

Mid-2023, Enspired x GSF

At around this time, the optimiser relationship linked to the strategy shift became visible externally. In early July 2023, enspired published a case study describing its partnership with GSF to optimise Cremzow revenues.

The connection between GSF and enspired is the basis for combining their performance reporting figures in this post.

December 2023, Half-Year Report (six months ended 30 September 2023)

By the time of the FY23/24 half-year report, Cremzow is no longer discussed in terms of “new capabilities”. FCR is part of a broader optimisation problem. Language hasn’t fully caught up with the practice at every point in the report, but the direction is clear.

Report link: https://www.gsenergystoragefund.com/docs/librariesprovider22/archive/results/interims-2023.pdf

December 2024 — Half-Year Report (six months ended 30 September 2024)

The previous year’s (FY23/24) half-year report spent time explaining “wholesale” trading and optimisation. By December 2024, this explanatory layer has disappeared. Cremzow is reported matter-of-factly as a 22 MW / 29 MWh operational asset, with revenues split between ancillary services and wholesale trading without comment or caveat. Practices that were still being articulated in 2023 had become assumed by 2024.

Report link:

https://www.gsenergystoragefund.com/docs/librariesprovider22/archive/reports/half-year-report-2024.pdf

July 2025 — Annual Report (FY ended 31 March 2025)

As part of this report, GSF disclosed quarterly revenue figures for Germany, enabling period-by-period tracking of revenue developments. This level of disclosure makes it possible to align GSF’s reported revenues with portfolio-level performance data published by enspired at a more granular level.